Article | 8 December 2023

EU Anti-Tax Avoidance Directive III: A seven-step approach to the Unshell Directive

The EU directive targeting shell companies, the Anti-Tax Avoidance Directive III (“ATAD 3” or the “Directive”) is currently at the stage to be adopted in its final version for incorporation into national legislation. The first proposal for a directive was published on 22 December 2021 and was approved by the European Parliament on 17 January 2023 with some amendments. The Directive is currently with the Council of the EU and the EU member states for unanimous and final proposal. ATAD 3 was initially planned to enter into force on 1 January 2024, but it is likely that this date will be moved forward. The assessment of a shell company under the Directive is made based on circumstances during the last two tax years, i.e., according to the original timetable from 1 January 2022. In this article, a seven-step approach to the Directive is presented.

Note that this article does not cover the European Parliament’s amendments to ATAD 3.

The Directive targets a scheme used for tax avoidance or tax evasion purposes involving the setting up of companies within the EU to enable certain tax advantages to flow to the company’s beneficial owner or group. The Directive aims to capture all companies that can be considered resident in a member state, regardless of their legal form.

Step 1: Carve-outs

Companies falling within any of the following five categories are carved-out from the coverage of ATAD 3 as they are considered as low-risk cases and thus not subject to the reporting requirement of the Directive. The carve-outs are not assessed at group level but for each company individually. A company directly or indirectly owned by a carved-out company, which is not itself carved-out, can therefore potentially be subject to ATAD 3.

- Companies with transferable securities listed on a regulated market or multilateral trading facility.

- Regulated financial companies, for example UCITS, AIF and AIFM.

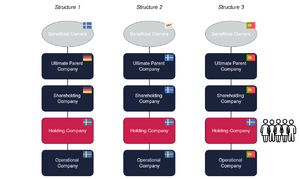

- Holding companies with shares in operational businesses in the same EU member state, with beneficial owners also tax resident in the same state. (See Structure 1 below.)

- Holding companies tax resident in the same member state as the company’s shareholder(s) or ultimate parent company. (See Structure 2 below.)

- Companies with at least five full-time employees, or employees exclusively carrying out the activities generating the relevant income. (See Structure 3 below.)

Step 2: Gateway test

ATAD 3 includes a substance test in two parts where the first part is the gateway thresholds with three cumulative criteria. If a company passes the gateway, it is considered as a high-risk company and will in the second part need to report on substance indicators. It is the company itself that must assess whether the criteria are met. However, member states can request a tax audit of a company suspected of passing the thresholds. Low-risk cases that do not meet the criteria are considered irrelevant for the purposes of the Directive.

- Passive or financial income

More than 75% of the company’s income during the last two tax years is “relevant income”, which is defined as passive or financial income, for example interest, royalties, and dividends. Alternatively, the book value of the company’s shareholding or the company’s immovable and movable property that generates such relevant income exceed 75% of the total book value of the company’s assets.

- Cross-border activity

More than 60% of the company’s relevant income according to the first point is derived from or transferred to another jurisdiction. Alternatively, the corresponding percentage of the book value of the company’s immovable and movable property that generates relevant income according to the first point was located outside the company’s member state during the last two tax years.

- Outsourced administration and decision-making

During the last two tax years, the company has outsourced the administration of day-to-day operations and the decision-making on significant functions.

However, no guidance is given in the Directive on how to determine what such activities and functions are, but risk companies should ensure that board documentation is on order and available to support that administration and decision-making takes place in-house. It is also not clarified whether intra-group outsourcing passes the threshold.

Exemption – no tax benefit

A company that does not pass the gateway test can request to be exempted from the reporting requirements in ATAD 3 if the company proves that the company’s existence does not lead to any tax benefits for the company’s beneficial owners or the group of which the company is a part. That is, the company was established for genuine commercial purposes. If the absence of such reduced tax liability is proven by comparing the tax amounts paid by beneficial owners and the group and the amounts that would have been paid if the company did not exist, and these circumstances remain unchanged, the exemption may be valid initially during the tax year and for a further five years.

Many structures may have several levels of potential shell companies where a tax benefit may arise from the combination of companies but not through one. It is not clear in the Directive whether the establishment and existence of only one, or all, companies with an interposition shall be considered when assessing any tax benefit.

Step 3: Minimum substance

In the second part of the Directive’s substance test the company must report meeting of three indicators of minimum substance for tax purposes in its annual tax return, by accompanying of documentary evidence with specific information. If all criteria are met, the company is presumed to have minimum substance for the current tax year and is therefore not a shell company according to ATAD 3.

- Premises

The company has own premises, or premises for its exclusive use, in its EU member state of residence.

- Bank account

The company has at least one own and active bank account in the EU.

- Indicators regarding directors of the board or full-time employees

At least one director in the company or the majority of the full-time equivalent employees of the company

- are resident for tax purposes in the member state of the company, or at no greater distance insofar as such distance is compatible with the proper performance of their duties,

- are qualified (and, regarding directors, authorised) to take decisions in relation to/carry out the activities that generate relevant income for the company,

- actively and independently use the authorisation referred to in point (ii) on a regular basis (director only), and

- are not employees or perform the function of director of another enterprise that is not an associated enterprise (director only).

Step 4: Presumption of shell company

A company that does not meet one or more of the indicators in step 3 is presumed not to have minimum substance for the current tax year and is thus presumed to be a shell company within the meaning of ATAD 3, i.e., a company being misused for tax purposes.

Step 5: Rebuttal

Companies that are presumed to be shell companies according to ATAD 3 shall be allowed to rebut this presumption by providing any additional supporting evidence of the business activities which they perform to generate relevant income. The supporting evidence shall prove that the company has performed and continuously had control over, and borne the risks of, the business activities that generated the relevant income or the company’s assets. If the shell company presumption is successfully rebutted it applies initially during the current tax year and, if the circumstances remain unchanged, for a further five years.

Step 6: Tax consequences

Structures with a company presumed to be a shell company due to not having minimum substance according to ATAD 3 is subject to extensive tax consequences within the EU. Structures with shell companies resident outside the EU fall outside the scope of the Directive. However, structures affecting such third countries may arise, e.g., when the shell company transfers income from or owns assets in such a third country or has shareholders resident in a third country.

Consequences in the shell company’s member state

The shell company shall

- be denied a request for a certificate of tax residence for use outside the jurisdiction of the member state, or

- be granted a certificate of tax residence which prescribes that the company is not entitled to the benefits of double tax treaties and relevant EU directives (for example, the parent/subsidiary directive and the interest/royalty directive).

Consequences in other member states

The shell company’s shareholder(s), if resident in the EU, shall

- be taxed in its member state for the company’s relevant income as if it had directly accrued to the shareholder, notwithstanding double tax treaties or relevant EU directives.

- be taxed in its member state for the company’s property generating relevant income as if such property was owned directly by the shareholder, without prejudice to double tax treaties or relevant EU directives.

- be taxed in the member state where immovable property of the company generating relevant income is situated for such property as if such property was owned directly by the shareholder, without prejudice to double tax treaties or relevant EU directives.

where the payer of relevant income is not resident in the EU

- be taxed in its member state for the company’s relevant income as if it had directly accrued to the shareholder, without prejudice to double tax treaties or relevant EU directives.

The payer of relevant income shall, where the shell company’s shareholder(s) is not resident in the EU,

- be subject to withholding tax in its member state, without prejudice to double tax treaties or relevant EU directives.

Irrespective of the above-standing, it should be noted that relevant income such as dividends and interest payments may in some cases be exempt from taxation in Sweden according to applicable Swedish legislation. This means that company structures with a Swedish shell company according to ATAD 3 do not necessarily need to rely on the elimination of double taxation according to double tax treaties and relevant EU directives, provided that Swedish legislation is not changed as a result of the implementation of ATAD 3. Currently, no such change of the law has been proposed. Although in some cases no direct tax consequences would arise in practice, the shell company is still subject to the reporting requirements of ATAD 3

Step 7: Information exchange and sanctions

All member states will, in accordance with existing mechanism of administrative cooperation in tax matters and automatic information exchange, have access to information on ATAD 3 shell companies. Information will be exchanged from the first part of the Directive’s substance test, i.e., when a company is considered as a high-risk company, as well as subsequent steps including certificates of rebuttal and exemption. The member states can further request that a specific company’s member state performs a tax audit if there is reason to believe that the company has no minimum substance within the meaning of the Directive.

ATAD 3 further stipulates that member states shall lay down penalties applicable against the violation of the reporting obligations in the Directive, which are proposed to include a sanction fee of at least 5% of the shell company’s turnover during the tax year in question.

Setterwalls’ comment

Although the Directive’s entry into force as mentioned is likely to be moved forward from the initial date of 1 January 2024, with regard to the fact that the assessment of a shell company is made based on circumstances during the last two tax years, risk companies should by this time review the company’s existing structure and substance. Due to the failure of the EU member states to reach unanimity, a final proposal is not expected until autumn 2024 at the earliest, when new representatives have joined the EU council. After that, entry into force cannot take place until the member states have had time to incorporate the Directive in its national legislation.

Setterwalls monitors the status regarding a final directive and entry into force. You are welcome to contact our tax team with questions about the substance requirements according to ATAD 3 and for advice on how your company can prepare for the implementation of the Directive.

The content is a general description of an informative nature only and is not legal advice to use as a basis for assessments in an individual case.

A summary of the article can be downloaded here: A seven-step approach to the Unshell Directive